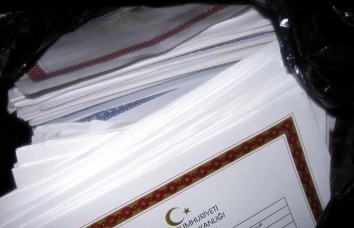

Local and Global Minimum Supplementary Corporate Tax in Turkish Law

In recent years, the increasing digitalization of economies has led to the emergence of many new business models and areas of activity. By leveraging the opportunities afforded by technological advancements, corporations have increased their mobility and begun to operate more easily in different countries.