A Critical Approach Towards “Valuable Housing Tax” Specific to Turkey

Introduction

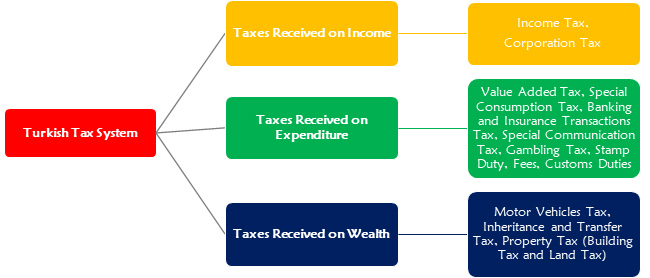

First of all, we can define the tax system as a system consisting of the sum of taxes applied in a country in a certain period. We can classify the taxes that make up this system according to various criteria. We see the most important of this classification as the separation of taxes by subject and the distinction between indirect and direct taxes. Within this framework, if taxes are classified as direct and indirect taxes, taxes received on income and wealth be included in the scope of direct taxes, and taxes received on expenditure will make up indirect taxes (Saraçoğlu, 2018: 1, 7).

In this respect, we can generally classify the taxes included in the Turkish Tax System in terms of their subjects and show them with the help of a shape.

The tax types of our age and the tax systems of the countries are the results of the existing economic structures. It is a natural condition to have a wide range of taxes in an environment where diverse policy options are available. Therefore, it is necessary to make an accurate classification in order to understand the qualifications of taxes. The reason we show this shape consists of these explanations.

A full and accurate comprehensible of financial power requires the implementation of taxes received on income, wealth or ownership and expenditures all together and coordination (Saraçoğlu, 2019: 35). The concept of financial power here can be used as a convenient means of direct taxes on income and wealth as it implies a person’s goods and ware. In return for this, this situation is seen to be difficult for indirect taxes (Gerçek et al., 2014: 155-156). In public finance, it is accepted that the main indicators of persons financial strength are income, wealth and spending. The law-maker will turn to these sources in different intensities in accordance with pursuant to their own preferences in order to realize taxation according to this power. In this context, various purposes and measures can be utilized to ensure taxation according to this power (Öncel et al., 1985: 61).

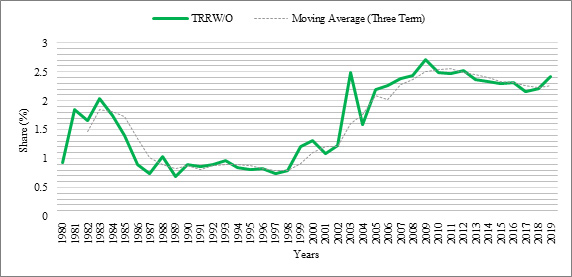

In our study, we will focus on taxes received on wealth in the first place. These taxes, typically included property tax (building tax and land tax), motor vehicle tax and inheritance tax. The real estate tax is rank among municipal revenues and collection is left to local authorities. In the Turkish Tax System, motor vehicle tax is rank among in this group since motor vehicles are paid regard to as a wealth element (Saraçoğlu, 2018: 7). The Inheritance and transfer tax are applied since the establishment of the Republic of Turkey, and it is a tax imposed due to the change of hands of wealth elements. This tax continues to be applied in order to comprehensible the wealth, which is one of the elements of the tax solvency (Saraçoğlu, 2018: 525). However, its share in total tax revenues is quite low (see Graph 1).

Note: * The data for 2019 is valid for December.

Sources: TR Ministry of Treasury and Finance and our own calculations.

On the other hand, wealth or ownership taxes can be regarded as one of the oldest financial instruments for the vast majority of countries. In terms of this historic feature, these taxes, which lay at the level of national wealth have been long ignored (Piketty and Zucman, 2014: 1263). Notwithstanding, wealth taxes, which have a long-established history compared to other tax practices have received less as theoretical and empirical attention in the field of public finance and taxation despite recently political debates (Cremer and Pestieau, 2009: 8). But, in the context of recently developments, it is seen that the taxes received on wealth continue to be discussed due to the fact that income distribution is more uneven. (1)

If we continue our discussion in the context of financial power, the excess and magnitude (such as the possession of relatively high value immovable and/or immovable assets) of the wealth elements can be considered as a measure of the height of financial power, and in this context, taxation method can be used.

In this context, as called “Valuable Housing Tax” in Turkey a tax has been coming into force. With this tax, in case of having one or more residential properties with high value, it is considered as the measure of the height of financial power and taxation is made.

In this study, we will try to examine the aforementioned tax, in general terms. Afterward, we will address potential problems related to this tax, and in many respects, we will put forward solution recommendations.

Valuable Housing Tax: Practices in Turkey

Valuable Housing Tax is regulated in articles 30-37 of Law No. 7194 published in the Official Gazette dated 7.12.2019 and numbered 7194. These articles have been added to Articles 42-49 of the Real Estate Tax Law No. 1319:

- Subject of the Tax (Article 42): The subject of tax covers immovable property situated in residential qualifications within the borders of Turkey. Within the scope of these immovables, the building tax value or the value determined by the General Directorate of Land Registry and Cadastre (the “Directorship”) of 5 million Turkish Lira and above are subject to this tax.

- Determination, Announcement And Finalization of Tax-related Values (Article 43): The determination of the tax values will be determined as a result of the valuation commissioned or made by the “Directorship” within the scope of the relevant legislation. The immovable property with a value of more than 5 million Turkish Liras and above will be announced on the website of the “Directorship” in a way to be accessible by the concerned persons. The person concerned will also be notified. From the date of the notification until the end of the fifteenth day, the immovable property value that is not objected to the “Directorship” will be finalized. Any objections made in due time will be evaluated and concluded within fifteen days. The finalized value will be announced and communicated to the person concerned by the same procedure. This value will be deemed to be the value determined by the “Directorship” in this tax practice.

- Tax Base And Proportion/Rate (Article 44): The base of this tax will cover the higher one of the building tax value and the value determined by the “Directorship”. The tax rate in this scope is as follows: (i) 3 per thousand for between 5 to 7,5 million Turkish Liras; (ii) 6 per thousand for 7,5 (7,500,001) to 10 million Turkish Liras; and (iii) 10 per thousand for those exceeding 10 million (10,000,001) Turkish Liras. The total value of this property shall be taken into consideration in the calculation of this tax base for joint ownership and common ownership. Amounts within the scope of these articles will be increased each year at the revaluation rate determined in accordance with the provisions of the Tax Procedural Law No. 213 for the previous year. The fractions of the amounts to be calculated in this context up to 10,000 Turkish Liras will not be taken into consideration. Finally, the value of the immovable determined by the “Directorship” will not be increased at the revaluation rate in the year of valuation.

- Tax Obligation (Article 45): The proprietor of these immovables will pay this tax. If there is a usufruct right holder of these immovables, he will pay this tax. If these two are not available, those who make savings, such as the owner of this property, will pay this tax. Those who are the owners of common ownership related to this immovable are liable to share in proportion to their shares. Owners in joint ownership will be jointly and severally liable for this tax. The obligation of this tax will start as follows: (i) as of the date on which this immovable value exceeds the value (including this amount) specified in Article 42 of the value of the building tax value or the value determined by the “Directorship”, (ii) as of the date when such changes occur if there are reasons to amend the tax value stated in Articles 33/(1)-(7) of the Real Estate Tax Law, and (iii) as of the date the exemption was dropped. The liability for this tax will begin from the year following these dates. The obligation for these immovable properties that have been burned, destroyed, completely rendered unusable or which have been exempted from tax, will cease from the installment following the date on which these events occur.

- Exemptions (Article 46) (2): The exemptions from this tax are as follows: (i) Residential real estates where general and special budget administrations, municipalities and universities have ownership or usufruct rights are exempt from this tax. (ii) People who are located within the borders of Turkey and have one (dwelling) immovable are exempt from this tax(3) (iii) These immovable properties belonging to foreign states and used as embassies and consulates and these immovable properties specific to the residence of the ambassadors are exempt from this tax(4). (iv) Immovable properties registered to the enterprises of those whose main activity is building construction and those which are not yet subject to the initial sale, transfer and assignment and newly constructed(5).

- Declaration of Tax, Payment Period And Place of Payment (Article 47): The tax declaration will be submitted to the competent tax authority which is affiliated to the Revenue Administration at the location of this immovable property(6). This property must be declared by a declaration by the end of february (twentieth day) of the year following the year in which the value of the immovable exceeds 5 million Turkish Liras (including this amount). This tax will be assessed and accrued per annum by the competent tax authority. For the following years, the taxpayer will be submitting an annual declaration and the tax will be assessed and accrued by the relevant tax authority. The tax assessed and accrued by the relevant tax authority will be paid in two equal installments until the end of february and august of the relevant year. In the event that there is a situation that requires the beginning of this tax liability within the year, the taxpayer will submit a tax return to the relevant tax office within the period of filing the tax declaration for the following year.

- Valuable Housing Tax Revenue (Article 48): This tax to be collected will be recorded as general budget revenue. This tax will not be taken into account in the calculation of the shares to be given to local administrators in accordance with Law No. 5779 and other laws.

- Authorization (Article 49): The competent authority is the Ministry of Treasury and Finance (the “Ministry”). The “Ministry” will determine the procedures and principles regarding the application of this tax. The “Ministry” will determine the documents to be sought for the application of exemptions. The “Ministry” is also authorized to extend the period of giving and paying the declarations within this scope up to three months. Therewith, the “Ministry” is authorized to determine the authorized tax office and the form, content, and annexes of the declaration. Finally, the “Ministry” is authorized to accrue this tax without seeking for a declaration.

Criticisms and Solution Recommendations for Valuable Housing Tax

First of all, it is noteworthy that the total asset value of taxpayers is not considered for the subject of this tax. In other words, valuation through a single housing will be done. For example, suppose one person has 10 housing and these housings are separately worth less than 5 million Turkish Liras. Since the immovable property of this person does not fall under the scope of this tax, it will not be possible to pay this tax. If the value of these immovables were 5 million Turkish Liras and more, it would be covered by this tax.

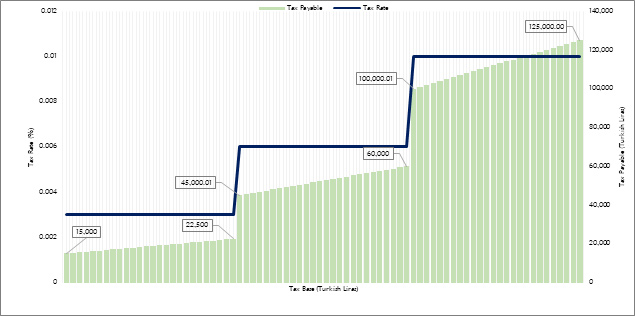

Let us now explain the tax tariff in the context of this example. The base of this tax can be examined within the scope of progressive tax tariffs or tables. The tariff of this tax is covered by the class procedure progressive tariff which is included in this increasing proportionality. This tax tariff is also called ‘straight’ or ‘solid proportionality’. In this tax tariff, the tax rate applies not only to the opposite tax base bracket but also it is applied to all base that is within the scope of the tax bracket. In other words, if the tax bracket to which the income subject to tax (the value of the relevant immovable for our example) is increasing, the rate to be applied to the whole base increases, and therefore, as the class changes, so does the tax rate to be applied to the overall base increases (Akdoğan, 2016: 248).

Let us explain this situation with our example. In our example, we assume that the value of the two immovable property of the taxpayer is 7,500,000 and 7,500,001 Turkish Liras. In the first instance, the taxpayer will pay a tax valued at 22,500 Turkish Liras, which will be calculated at the rate of 3 per thousand; in the latter instance, the taxpayer will pay a tax of valued at 45,000,01 Turkish Liras, which will be calculated at the rate of 6 per thousand. Thus, a lira increase in the tax base results in the increase of the tax burden to 22,500,01 Turkish Liras (see Graph 2). In this case, different dimensions may arise depending on the changes in the tax base and the rate to which it is subject.

Note: * The base of this tax is calculated up from 5 million Turkish Liras to 12.5 million (including these amounts),

and the increase in this tax base is kept constant at 0,1 million Turkish Liras.

Secondly, since the subject of the tax covers only includes the housing, it may lead to the controversy that establishment with a housing value of more than 5 million Turkish liras is excluded. In conjunction with, immovables that are used as an establishment but appear as housing in the land registry are also subject to tax.

Thirdly, when calculating the tax base in joint ownership and in co-ownership, looking at the total value instead of the share values in the residence may be problematic in terms of comprehending the financial power. The difference between these two can be explained as follows: (i) each proprietor in joint ownership is liable for this tax at the rate of his own share, and (ii) all owners in co-ownership are conjointly responsible for this tax. The responsibility here applies to immovable property situated in residential qualifications within the borders of Turkey. The implication of the problem here is that although the values possessed of the shareholders are below 5 million Turkish Liras separately, this causes them to become taxpayers. For example, if 5 people own a dwelling worth 10 million Turkish Liras with equal shares, each of these shares corresponds to 2 million Turkish Liras, and these shareholders subject to be covered by the tax obligation (Saraçoğlu, 2019: 37).

A fourth assessment concerns the exemptions (exclusions) that this tax covers. Immovable property situated in residential qualifications within the borders of Turkey owned by those who certify that they have no income, exempt from this tax. In this context, this exemption may lead to work to leave the job or work informally for persons who are covered by the tax but are employed. If the value of the valuable housing tax to be paid by these persons, in particular, is higher than the income they acquired, there may be a potential to choose this path (Saraçoğlu, 2019: 39). Correspondingly, the income related to this tax may not be realized at the desired level.

The fifth concerns the issue of double taxation. Primarily, this problem means that two taxes are collected from the same housing, both real estate (building) tax and valuable housing tax. According to Article 1 of the Real Estate Tax Law No. 1319, the buildings are located within the borders of Turkey constitute the subject of property tax. The taxpayers of these two taxes are the same. The important thing to note here is that the taxpayer takes shape according to the tax issue. The tax base in the building tax articulate the tax value of the building determined according to the provisions of this law (Real Estate Tax Law, Article 7). Although it can be stated that the tax bases are different, inherently the problem of double taxation seems to be clear (Saraçoğlu, 2019: 40). Because both are included in the description of the building. In this respect, we can emphasize that the housing which is covered by the valuable housing tax should be excluded from the real estate tax. It should be noted that this does not mean that no valuable housing tax will be charged. The first purpose of this emphasis is on the reorganization of the revenue for valuable housing tax elsewhere. The second aim is related to the regularization of tax systematics. In general, the systematic of taxes is important in terms of the effect of tax on the functioning of the economy, directing the decisions of economic decision-making units and the implementation and follow-up of tax policy.

The sixth and final assessment is related to the transmutation of valuable housing tax into revenues and public expenditure. On the revenues side, the number of dwellings covered by this tax and how much revenue is expected are incline. According to the information shared in the Plan and Budget Commission, this tax will initially cover 103,000 dwellings (Grand National Assembly of Turkey, 2019: 84). According to a study, it is stated that approximately 150 thousand homeowners are expected to be affected by this tax(7). In the first one, it is stated that the yield of this tax is expected to be between 2,5 to 3 million Turkish Liras. In the face of negotiations held in the Plan and Budget Commission, according to Indexa’s research, it may be possible for a higher number of dwellings to be included in the scope of the tax and thus higher tax revenue (Saraçoğlu, 2019: 40). At this point, there are some imperfect in the way that the data is not shared with all details and what the value of this dwelling is determined according to. Elimination of these imperfect aspects is important for the analysis of many aspects of this tax. On the expenditure side, it is to question the underlying reason how the income from (tax revenues received on wealth) this tax is spent. It is worth mentioning that what we want to discuss on this side is to emphasize the important role of expenditure policies in improving income distribution. The nature of the public expenditure items constituting this expenditure policy is also important. In this context, empirical studies (8) conducted in various countries show that transfer expenditures, we see that the focus is on the effect of transfer expenditures for social purposeful in particular. Because these items are considered as expenditure items that should have an impact on income distribution in terms of their intended use.

Of course, discussing the dimension of these effects exceeds the limit of this study. Here we have made a reference to the impact on income distribution in the context of how tax revenues are generally spent or how spending policy is shaped.

Conclusion

The fact that taxpayers’ income and wealth are at different levels necessitates to take this difference into account when taxing, and the taxation of these taxpayers according to their financial strength needs to serve a purpose both to comply with the constitutional regulation and to ensure tax justice. Therewithal, in order to measure the impact of taxes on income distribution, features such as the tax rate applied, the ability to pay, the nature of the taxes and the means of reflectance must be taken into account.

In general, a progressive structure (table) of taxation affects the distribution of personal income and wealth, and if not absolute, eliminate the inequalities in the distribution of income between labor and capital. Changes to this progressive tax structure may have different effects on income distribution for low, middle or high-income groups.

In order to eliminate as relative the inequality in income distribution, taxes received on wealth or ownership can assume an important function. As a matter of fact, the valuable housing tax has been put into practice within this context. In this context, we can add this tax to Figure 1. When the justification of Article 33 of the Law No. 7194 is considered, it is stated that it is difficult for the citizens at the general welfare level to have one or more dwelling with high value. In this context, it is emphasized that this difficulty can be considered as a benchmark for the height of financial power.

In addition to this, these and similar challenges need to be taken into account as a whole in terms of tax structure and income distribution. Our assessments of this tax are of vital importance for the fulfillment of the objectives expected from this tax and in this direction, this tax should be reviewed in a holistic framework.

- Akdoğan, Abdurrahman. (2016), Kamu Maliyesi, Gözden Geçirilmiş ve Genişletilmiş 17. Baskı, Gazi Kitabevi, Ankara, ISBN: 978-605-344-442-8.

- Bandyopadhyay, Sanghamitra and Esteban, Joan Maria. (2007), Redistributive Taxation and Public Expenditures, LSE STICERD Research Paper No. 95, London.

- Brülhart, Marius; Gruber, Jonathan; Krapf, Matthias, and Schmidheiny, Kurt. (2019), Behavioral Responses to Wealth Taxes: Evidence from Switzerland, CESifo Working Paper Series 7908, CESifo Group Munich.

- Cremer, Helmuth and Pestieau, Pierre. (July 2009), “Wealth and Wealth Transfer Taxation-A Survey”, Paper to be presented at the conference “Tax Systems: Whence and Whither?”, Malaga September 9-11.

- Demiryürek Ürper, Tuba. (2018) The Impacts of Public Expenditures on Income Distribution: Turkey As A Case Study, Master’s Thesis, Ankara.

- Grand National Assembly of Turkey (PBC). (November 6, 2019), İstanbul Milletvekili Vedat Demiröz ve 97 Milletvekilinin Dijital Hizmet Vergisi Kanunu ile Bazı Kanunlarda ve 375 Sayılı Kanun Hükmünde Kararnamede - Değişiklik Yapılması Hakkında Kanun Teklifi (2/2312) ile Plan ve Bütçe Komisyonu Raporu, Legislative Session: 27, Legislative Year: 3, Ordinal Number: 128, https://www.tbmm.gov.tr/sirasayi/donem27/yil01/ss128.pdf.

- Gerçek, Adnan; Bakar, Feride; Mercimek, Fulya; Çakır, Erdem Utku, and Asa, Semih. (2014), “Vergilemenin Anayasal Temellerinin Çeşitli Ülkeler Açısından Karşılaştırılması ve Türkiye İçin Çıkarımlar (Comparison of Taxation’s Constitutional Foundations in Various Countries and Inferences for Turkey)”, Ankara Üniversitesi Hukuk Fakültesi Dergisi, Volume: 63, Issue: 1, pp. 81-130.

- Indexa. (December 23, 2019), “Precious Housing Tax will affect 147 thousand structures”, Indexa Blog: https://www.endeksa.com/en/blog/yazi/degerli-konut-vergisi-147-bin-yapiyi-etkileyecek, (Date Accessed: December 30, 2019).

- Jakobsen, Katrine; Jakobsen, Kristian; Kleven, Henrik, and Zucman, Gabriel. (2018), Wealth Taxation and Wealth Accumulation: Theory and Evidence from Denmark, NBER Working Paper No. 24371, Cambridge, MA.

- Öncel, Mualla; Çağan, Nami, and Kumrulu, Ahmet. (1985), Vergi Hukuku, Cilt: 1, 2. Baskı, Ankara Üniversitesi Siyasal Bilgiler Fakültesi Yayınları, Yayın No: 548, Ankara.

- Piketty, Thomas and Zucman, Gabriel. (August 2014), “Capital is Back: Wealth-Income Ratios in Rich Countries 1700-2010”, The Quarterly Journal of Economics, Volume: 129, Issue: 3, pp. 1255-1310.

- Saez, Emmanuel and Zucman, Gabriel. (2019), “Progressive Wealth Taxation”, Brookings Papers on Economic Activity, BPEA Conference Drafts, September 5-6.

- Saraçoğlu, Fatih. (2018), Türk Vergi Sistemi, Güncellenmiş 7. Baskı, Gazi Kitabevi, Ankara, ISBN: 978-605-344-772-6.

- Saraçoğlu, Fatih. (2019), “Değerli Konut Vergisi Üzerine Değerlendirmeler (The Assessments on Valuable Housing Tax)”, Vergi Raporu, Issue: 243, pp. 34-41.

- Viard, Alan D. (2019), “Wealth Taxation: An Overview of the Issues” in Maintaining the Strength of American Capitalism, (Ed.) Melissa S. Kearney and Amy Ganz, Aspen Institute Economic Strategy Group.

- Wolff, Edward N. (2019), Wealth Taxation in the United States, NBER Working Paper No. 26544, Cambridge, MA.

(1) See Jakobsen et al. (2018), Saez and Zucman (2019), Wolff (2019), Brülhart et al. (2019) and Viard (2019).

(2) Under this law, although it has been named as an exemption, these regulations (Article 46) included characteristics in the tax exception. Exemption refers to the exclusion from the nontax of persons or groups of persons. In return for this, the exception means that the tax subject leaves out from the nontax.

(3) Within the scope of this provision, the person who are obliged to take care of them and those who have not reached the age of eighteen are excluded. These immovables owned by those who certify that they have no income, whose income consists only of the pension received from social security institutions established by law are exempt from this tax. At this point, it should be noted that the usufruct right is included. This provision shall also apply to the portion of the shares in the event that these persons own a house with shares

(4) Here, the condition of reciprocity regarding the immovables of this nature is stipulated. Therewith, this qualified real property belonging to the central offices of international organizations in Turkey with the international organizations in Turkey are exempt from this tax.

(5) This includes the remaining qualified (dwelling) immovable of the contractor who undertakes the contracting works in accordance with the contract for the construction works against the land. In the scope of this provision, the exclusion of the rental or other use of these immovable properties is excluded.

(6) In the case of co-ownership, taxpayers may submit joint declarations. At the same time, they may also submit individual declarations. In the case of common ownership, the declaration will be submitted individually.

(7) For details of the research, see. Indexa, “Precious Housing Tax will affect 147 thousand structures”

(8) See Bandyopadhyay and Esteban (2007) and Demiryürek Ürper (2018).